Looking to sell your property portfolio?

We’ll buy your property portfolio fast, and hassle-free. We’re interested in buying anywhere between 1 and 100 properties in a single transaction.

To get started, fill out the form below 👇 or call 0191 486 2386.

In fact, some reports suggest that as many as 25% of landlords are planning to sell some or all of their property portfolios.

How it works

Selling your property portfolio to us is as easy as 1 2 3…literally.

And with some of the proposed changes that are due to come into effect over the next few years, it’s likely to become even more difficult for landlords to see the returns they once did.

1.Make an enquiry

Get in touch and give us a few details about your property portfolio. We’re interested in portfolios of all sizes, from 1 to 100 properties.

2. Receive a no obligation cash offer

We’ll be in touch with a cash offer within 48 hours of you contacting us, and you’re under no obligation whatsoever.

3. Sell within a timescale to suit you

You decide how quickly you’d like the sale to go through. Then just sit back and let us take care of the process.

The government’s proposal to remove Section 21 is likely to make rental properties harder to sell, while the changes to minimum EPC ratings on rental properties could see landlords hit with bills running into thousands.

Why sell your investment property to us?

The buy-to-let market isn’t as lucrative as it once was. Things like new government legislation, increased taxes – especially Section 24 – and new council HMO licensing requirements have made many landlords question whether to continue or not.

In fact, some reports suggest that as many as 25% of landlords are planning to sell some or all of their property portfolios.

And with some of the proposed changes that are due to come into effect over the next few years, it’s likely to become even more difficult for landlords to see the returns they once did.

The government’s proposal to remove Section 21 is likely to make rental properties harder to sell, while the changes to minimum EPC ratings on rental properties could see landlords hit with bills running into thousands.

The requirement to have a minimum EPC rating of C from 2025 will mean average upgrade costs of around £7,000 for landlords whose properties currently fall short. And failure to comply could mean a fine of up to £30,000.

Interesting Facts and Stats to Consider

![]() Stamp duty on a second property is the standard rate + 3%. On a £250,000 property, this equates to £10,000.***

Stamp duty on a second property is the standard rate + 3%. On a £250,000 property, this equates to £10,000.***

![]() Various reports have found that 20% to 25% of landlords are looking to sell.*

Various reports have found that 20% to 25% of landlords are looking to sell.*

![]() Over 50% of landlords lost out on rental income due to COVID-19*

Over 50% of landlords lost out on rental income due to COVID-19*

![]() 47% of landlords lost between £2,000 and £10,000 in rental income as a result of the pandemic*

47% of landlords lost between £2,000 and £10,000 in rental income as a result of the pandemic*

![]() 27% of tenants were unable to pay their rent during the worst of the pandemic*

27% of tenants were unable to pay their rent during the worst of the pandemic*

![]() 67% of landlords have said they would consider other forms of property investment in future instead of buy-to-lets and second homes**

67% of landlords have said they would consider other forms of property investment in future instead of buy-to-lets and second homes**

![]() 76% of councils have seen a rise in landlords selling properties in their areas

76% of councils have seen a rise in landlords selling properties in their areas

Aside from the extra costs mentioned above, you may find yourself recognising some of the following situations:

- Change of career

- Problem tenants

- Owing more than the property’s worth

- High letting agents fees

- High cost of improvements

- Poor letting agents management

Whatever your reasons for wanting to sell your investment property, we can help. Regardless of your property’s status and location, we’re ready and waiting with a cash offer. We’re based in the North East but we buy property and land all over the country. So, whether your property portfolio…

- Needs costly repairs

- Has tenants in situ

- Is unappealing to standard buyers

- Is spread across the country

..it makes no difference to us. We’d love to chat with you about buying your investment property, regardless of its condition.

Selling to Sell With Richard Vs. selling via an estate agent

The traditional method of selling a property is a timely and expensive process, which can take many months and cost a lot of money.

In some cases it may be worth the hassle, but often the difference in profit between selling to an investor and selling via an estate agent can be minimal, and the difference in time and stress is significant.

| Checklist | Selling to Sell with Richard | Selling via an estate agent |

| Timeframe | As little as 14 days | 4+ months on average |

| Estate agent fees | 0% | Up to 3.5% |

| Decorating & repair costs | £0 | £1,000+ |

| Solicitor fees | £0 | £1,500+ |

| Cost of bills & council tax while property is vacant | £0 | £1,000+ |

| Clearance costs | £0 | £500+ |

| Eviction fees | £0 | £1,000+ |

| Gas safety certificate | £0 | £100 |

| Energy performance certificate | £0 | £80 |

| Changing the locks | £0 | £150+ |

| Bailiff fees (if required) | £0 | £500+ |

| Mortgage repayments | £0 | £2,000+ |

| Hassle & stress | ZERO | 10/10 |

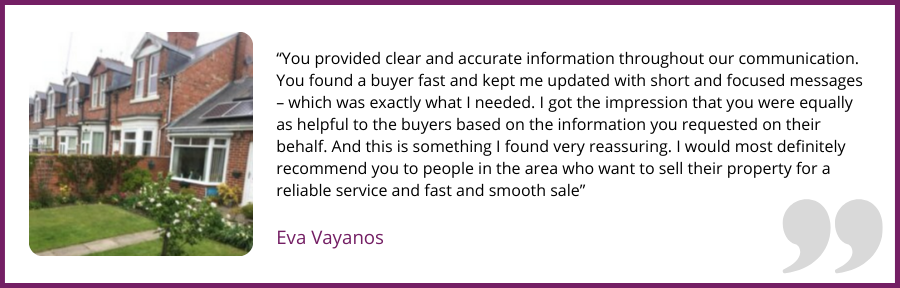

Testimonials

We’ve bought hundreds of properties across the UK, and helped dozens of buy-to-let owners looking to sell their property portfolio.

But don’t just take our word for it. Check out some of the comments our happy clients have said about our service…

FAQs

Does it matter what condition my investment property is in?

Not at all. We buy properties in any condition.Whether your property needs a lick of paint or a top-to-bottom refurb, we’re interested in buying.

What costs can I save by selling to you rather than a traditional sale through an estate agent?

The biggest saving you’ll make is on estate agent fees. On an average property you could be looking at around £6,500 based on fees of 2% plus VAT. By selling to us, the fee is ZERO.

You’d also have solicitors fees to pay, which are typically around £1,500 per property. By selling to us, the solicitor fees are ZERO.

Plus, there are numerous costs involved with getting the property ready to sell, such as obtaining an EPC and repair costs. Not to mention, ongoing costs like utility bills and mortgage payments. By selling to us, you’ll be able to drop all those costs immediately.

Will you buy a property with tenants in situ? What if they are problem tenants?

Absolutely. We’re happy to buy properties that are vacant or have tenants in situ. And if they’re problem tenants then that’s fine, we’d still love to chat about taking the property off your hands.

How quickly can I sell my property?

We can finalise a purchase in as little as 14 days. However, we’re happy to move at a pace to suit you, so if you’d like the process to take longer then that’s fine by us.

Does my property need an EPC?

No, unlike a traditional sale, we don’t require you to have an EPC.

Which areas do you buy property in?

We buy properties all over the UK, from Eastbourne to Edinburgh. And if your portfolio’s spread across the country, that’s fine too.

Our offices are based in the North East, but we travel the length and breadth of the country to buy property and land.

What types of property do you buy?

We buy all types of properties, from studio flats to detached houses, and even commercial properties too.

How can I sell my property portfolio?

With our simple process, selling your property portfolio is easy. There are three simple steps to selling.

1. Get in touch with us

2. Receive a no obligation cash offer within 48 hours

3. Decide on your timeframe for selling and let us take care of the rest

Is this all too good to be true?

Absolutely not. We’re landlords ourselves so we understand all of the challenges you face, such as the removal of Section 21, increased EPC costs and difficult tenants.

We typically help around 40 landlords every year, whose properties range from a single apartment to three figure portfolios.

We’ve got a robust team of solicitors, mortgage brokers and accountants on hand too, who can help to structure your property sale in a tax-efficient manner and overcome any legal or non-compliance issues.

We’re interested in properties of all shapes and sizes, across the UK. Whatever condition your property’s in, and whether you have one investment property or 100, book a free consultation with us today and we could be making you an offer within 48 hours.